Choosing the right Business Entity LLC, S-Corp, and C-Corp Welcome back to our series on choosing the right business structure. In Part 1, we explored the simplicity of the business entity of a Sole Proprietorships and Partnerships. While these can be great starting points, many businesses in California and New York eventually need a more robust structure that offers liability … Read More

Decoding Business Structures:

A CPA’s Guide for Entrepreneurs Starting a new business is an exhilarating journey, but the path to success is paved with critical decisions. One of the first and most fundamental choices you’ll make is selecting the right legal structure for your company. This decision has a lasting impact on everything from your personal liability to your tax bill. As a … Read More

Maximizing Your Retirement Income:

Uncovering Overlooked Tax Breaks for Retirees and Individuals Over 65 A TYS Accounting Guide Welcome to retirement—a time for you to reap the rewards of a lifetime of hard work. At TYS, we understand that transitioning to a fixed income requires careful financial planning, and a significant, yet often underestimated, part of that plan is strategic tax management. Many retirees … Read More

Navigating New Terrain: IRS Ruling 2023-2 and Your Estate Plan

New York to California – For years, families have turned to irrevocable trusts as a cornerstone of their estate planning, aiming to protect assets and ensure a smooth transfer to beneficiaries. A key concern in this process has always been the tax implications, particularly regarding capital gains. Historically, the “step-up in basis” has been a valuable benefit, potentially eliminating capital … Read More

California Dreamin’… About Your State Tax Refund?

Where’s My Refund TYS is familiar with California’s tax ecosystem, I can tell you: the anticipation around state refunds is real. You filed. You waited. And now you’re asking, “Where’s my refund?” How California Processes Your Refund Once you submit your return—either electronically or by mail—the Franchise Tax Board (FTB) typically processes e-filed returns in under 3 weeks. Paper returns? … Read More

“Where’s My Refund?” – The New York Edition

Every spring, New Yorkers become amateur detectives—trying to uncover the mystery of their missing refund. Where is my refund NY? As CPAs, we field this question daily: “Where is my state refund?” Let me give it to you straight. Understanding the Refund Timeline The New York State Department of Taxation and Finance typically issues refunds within: But that’s best-case scenario. … Read More

5 Simple Steps to Make Tax Season Less Stressful

Tax Tips for Reducing Taxable Income. Tax season doesn’t have to be overwhelming. Whether you’re an employee or a small business owner, staying organized and proactive throughout the year can make filing your taxes a smoother and less stressful experience. Here are five practical tips to help you stay on top of your taxes and potentially save money along the … Read More

Celebrating Madam C.J. Walker

A Pioneer in Beauty and Business – Madam C.J. Walker This Black History Month, we honor Madam C.J. Walker, a trailblazer who transformed the beauty industry and empowered countless women. Born Sarah Breedlove in 1867 to formerly enslaved parents, Madam Walker overcame immense challenges to become America’s first self-made female millionaire. Madam Walker’s journey began with a simple yet revolutionary … Read More

The Founding of the NABA:

A Story of Perseverance and Unity In the late 1960s, the accounting profession in the United States was overwhelmingly white and male. African Americans faced significant barriers to entry, including racial discrimination, limited access to education, and a lack of mentorship and networking opportunities. Despite these challenges, a group of nine visionary Black accountants came together to create an organization … Read More

The Story of Mary T. Washington:

America’s First Black Woman CPA In the bustling city of Chicago during the early 20th century, a young girl named Mary Thelma Morrison grew up with a keen mind for numbers. Born in 1906, Mary was raised by her aunt and uncle after her mother passed away when she was just a child. Despite the challenges of growing up during … Read More

Major 401(k) Changes in 2025

Maximize Your Retirement Savings Investing in a 401(k) is one of the smartest ways to build wealth for retirement. With automatic paycheck deductions, tax benefits, and potential employer matches, it’s a no-brainer for those looking to secure their financial future. 401k Changes In 2025, the IRS is introducing key changes that could impact your contributions and tax savings. Here’s what … Read More

Preparing for the 2025 Tax Season

As the 2025 tax season approaches, it’s essential for all taxpayers, including small business owners and individuals from various income levels, to proactively prepare for their 2024 federal income tax returns. Early preparation not only streamlines the process but also minimizes risks and ensures compliance with evolving tax regulations. Here are the essential steps you should take: Leverage Enhanced IRS … Read More

Tax Tips for Reducing Taxable Income

Tax Tips for Reducing Taxable Income. Tax season doesn’t have to be overwhelming. Whether you’re an employee or a small business owner, staying organized and proactive throughout the year can make filing your taxes a smoother and less stressful experience. Here are five practical tips to help you stay on top of your taxes and potentially save money along the … Read More

IRS Tax Updates for 2025

Tax Code Changes are coming The IRS has announced a wide range of tax code changes set to take effect in the 2025 tax year, and they could influence everything from how much you owe to how you manage your savings. These updates, released in late October, aim to help counter ongoing inflation and ease some of the financial pressure … Read More

Maximize Your Retirement Savings with the Saver’s Credit

The Internal Revenue Service (IRS) encourages low- and moderate-income taxpayers to take advantage of the Saver’s Credit—a valuable tax incentive that rewards contributions to retirement accounts. By saving for your future today, you could reduce your tax bill or increase your refund in 2025 and beyond. What Is the Saver’s Credit? Also known as the Retirement Savings Contributions Credit, the … Read More

Notable changes for tax year 2025

IRS announces new federal income tax brackets for 2025 The IRS has announced new federal income tax brackets and standard deductions for 2025. In its announcement on Tuesday, the agency raised the income thresholds for each bracket, which applies to tax year 2025 for returns filed in 2026. The top rate of 37% applies to individuals with taxable income above … Read More

Tax Relief in Disaster Situations: What You Need to Know

When a natural disaster strikes, the IRS can offer disaster tax relief to help those impacted. This assistance comes after the Federal Emergency Management Agency (FEMA) meets certain criteria and declares a major disaster area. If at least one location qualifies for FEMA’s Individual Assistance program, the IRS will provide tax relief to the affected areas. For those affected by … Read More

Taxpayer Advocate Service

Try as you might to do the right thing, you may still end up coming face to face with a disagreement with the IRS. Did you know there was an independent organization whose mission is to help you and act as a taxpayer’s voice. The Taxpayer Advocate Service is an independent organization within the IRS. TAS protects taxpayers’ rights by striving … Read More

Learn about – Employer-offered educational assistance programs

An educational assistance program that is offered by an employer must be one that is a written plan PDF to provide employees with undergraduate or graduate-level educational assistance. These programs allow employers to pay student loan debt and other education expenses tax-free. Eligible expenses Educational assistance programs can help pay for: Loan payments These programs can be used to pay principal and interest … Read More

Clean Energy Tax Credit – IRS Warns of a new scam .

The Internal Revenue Service (IRS) has issued a critical alert regarding an emerging fraudulent scheme involving the misappropriation of clean energy tax credits established under the Inflation Reduction Act (IRA). This sophisticated scam exploits the transferability provisions of the IRA, which allow for the purchase of eligible federal income tax credits derived from clean energy investments. Unscrupulous tax preparers are … Read More

Facts in Accounting you didn’t know

Fun Accounting Facts you may not have known about! Accounting tends to be much of an afterthought in today’s society. Maybe seen as a little boring? Try running a business without it, or see how well your own household finances fair neglecting it. However, accounting is a discipline that crucial to our economy and way of life. Accounting can be … Read More

Taxpayers right to pay no more than what is due

Taxpayers have the right to pay no more than the correct amount of tax The IRS works hard to make sure taxpayers pay no more than the correct amount of tax. Taxpayers have the right to pay only the amount of tax legally due, including interest and penalties, and to have the IRS apply all tax payments properly. This is … Read More

Digital Asset Reporting & Tax Requirements

What taxpayers need to know about digital asset reporting Taxpayers filing 2023 tax returns must check a box indicating whether they received digital assets as a reward, award or payment for property or services or disposed of any digital asset that was held as a capital asset through a sale, exchange or transfer.A digital asset is a digital representation of … Read More

What happens if your are audited?

So what is an IRS Audit? Usually you hear the term audit and you cringe at the thought. If it isn’t part of some TV sitcom punchline, you want no part of it. Audits can be brutal or they can just be a necessary nuisance. So here is what an IRS audit entails. An IRS audit constitutes a thorough assessment … Read More

Taxpayer Bill of Rights

In 2014 the IRS adopted a Taxpayer Bill of Rights. It applies to all taxpayers in their dealings with the IRS. The Taxpayer Bill of Rights groups the existing rights in the tax code into ten fundamental rights, and makes them clear, understandable, and accessible. The Taxpayer Bill of Rights is the 10 rights all taxpayers have any time they interact with … Read More

Tax credits and deductions for individuals

Tax credits and deductions change the amount of a person’s tax bill or refund. People should understand which credits and deductions they can claim and the records they need to show their eligibility. Tax credits A tax credit reduces the income tax bill dollar-for-dollar that a taxpayer owes based on their tax return. Some tax credits, such as the Earned Income Tax Credit, … Read More

Corporate Transparency Act (CTA)

You might have heard about it, the Corporate Transparency Act (CTA), enacted in 2021, was passed to enhance transparency in entity structures and ownership to combat money laundering, tax fraud, and other illicit activities. It is designed to capture more information about the ownership of specific entities operating in or accessing the U.S. market. The effective date of the Corporate … Read More

Expert Tips for Minimizing Your Tax Burden Legally

Maximizing Your Tax Efficiency In the ever-evolving landscape of taxation, finding ways to minimize your tax burden legally is essential for both individuals and businesses. TYS is here to guide you through the most important strategies to help you optimize your tax efficiency while staying within the bounds of the law. In this comprehensive guide, we will explore key tax-saving … Read More

Tax Season is coming.

Things to consider when choosing a tax return preparer Once you have selected a tax preparer, look for these traits. Good preparers ask to see records and receipts. They’ll also ask questions to determine the client’s total income, deductions, tax credits and other items. As a taxpayers should avoid a tax return preparer who e-files using pay stubs instead of … Read More

The IRS ends unannounced visits.

The Internal Revenue Service has been going through some changes in order to modernize and consolidate how it operates. The latest in that effort is a major policy change that will end most unannounced visits to taxpayers by agency revenue officers to reduce public confusion and enhance overall safety measures for taxpayers and employees. The change reverses a decades-long practice … Read More

Tax Deductions and Programs for New Homeowners

The summer months are a popular time to buy or sell a house. New homeowners should put reviewing the tax deductions, programs and housing allowances they may be eligible for on their move in to-do list. Deductible house-related expenses Most home buyers take out a mortgage loan to buy their home and then make monthly payments to the mortgage holder. … Read More

New IRS Refund Scam

IRS has issued a warning to taxpayers about a recently discovered refund scam that is being sent through the mail. Read on to learn how to protect your personal information and avoid falling victim to identity theft. Recognizing the IRS Refund Scam The fraudulent letter arrives in a cardboard envelope, cleverly designed to deceive unsuspecting individuals into believing that they … Read More

Tax Strategy

Tax Strategy: Minimize Your Tax Liability Legally Do you think you are paying too much in taxes? It’s possible. Do you want to ensure that you are taking full advantage of all the tax breaks and deductions that are available to you? If so, then working with a tax strategist can help. A tax strategist can provide you with the … Read More

Why get an accountant?

More than an accountant. Using an accountant who is also your business advisor can provide several benefits for your business. Heightening your business awareness for higher profit is just one of them. Here are a few key benefits: Overall, using an accountant who is also your business advisor can provide valuable guidance and support for your business. By leveraging their … Read More

The Importance of a Surety Bond in Construction Project.

Construction companies planning to take a loan from a bank or work on a government project, will need a construction accounting expert to secure a surety bond. Surety bonding acts as a guarantee that the construction company will perform the work as agreed upon in the contract. In case of any default, the surety bond protects the obligee, which can … Read More

The Power of Accountants as Holistic Business Advisors

In today’s rapidly evolving business landscape, accounting firms face the imperative of staying competitive and adapting to the changing needs of their clients. Traditional bookkeeping and tax preparation services, while essential, are no longer sufficient to meet the demands of businesses seeking comprehensive financial guidance. To remain at the forefront of the industry, accounting firms are shifting towards a new … Read More

Getting Ready for Tax Season

With 2022 well in the rearview mirror, it is time to get ready for filing your taxes. Yes, I know it can be intimidating, but your taxes are due on April 18 this year. Before you know it, Tax Day will be here. So, it’s a good idea to start getting ready for tax season as soon as possible. Here … Read More

Tax Code update:Things you should know.

Tax Law changes Well, 2022 was certainly an interesting year and the recent tax law changes are going to keep it interesting. Here are some of the changes and issues you need to know about.Research and Development: Under the Tax Cuts and Jobs Act (TCJA), for taxable years beginning after December 31, 2021, specified research or experimental expenditures must be capitalized … Read More

Taxes, what you don’t know can cost you.

Regarding taxes, what you don’t know can cost you. Looking for a way to minimize your tax liability? Look no further than our tax accounting services! We specialize in helping our clients manage their income tax obligations in the most efficient way possible.Taxes are an unavoidable obligation whether you’re a business or an individual. And while they may not be … Read More

Interest Assessment Surcharge and what you need to know.

TYS wanted to answer some questions you might have about the New York State IAS or Interest Assessment Surcharge. Just to remind you why the IAS is something you should be aware of, here are some details. In March 2020, the federal government passed the CARES Act, creating several pandemic unemployment programs to support out-of-work Americans impacted by the COVID-19 pandemic. … Read More

What taxpayers need to know about business related travel deductions

Travel Deductions, learn to get it right. With inflation on the rise, business travel can be costly. Hotel, airfare, train tickets, cab fare, public transportation, meals – it can all add up fast. The good news is business travelers may be able to off-set some of those costs by claiming business travel deductions when they file their taxes. Good record … Read More

What businesses need to know about reporting non-employee compensation and backup withholding to the IRS

When a business hires an independent contractor, the employer is generally not responsible for withholding income taxes, Social Security, or Medicare taxes from their compensation. However, by law, business taxpayers who pay non-employee compensation of $600 or more must report these payments to the IRS. They do this using Form 1099-NEC, Non-employee Compensation. Generally, payers must file Form 1099-NEC by January … Read More

Should you hire a professional accountant?

Knowing when it is time to hire a professional accountant. If you run your own business or are part of the gig economy you may be wondering if it is finally time to hire an accountant. What are the signs that it is time to hire a professional and why would you want to? Professional accountants can do more than … Read More

Taxpayers who have not yet filed their 2021 tax return

October 17, 2022, extension deadline Check the IRS Directory of Federal Tax Return Preparers. This searchable and sortable public directory helps taxpayers find a tax return preparer with specific qualifications. Check the preparer’s history with the Better Business Bureau. Taxpayers should check for any disciplinary actions for credentialed tax return preparers. For CPAs, check with the State Board of Accountancy. … Read More

Don’t file your tax return before you’re ready

Don’t file your return before you’re ready Taxpayers should never file late, but they shouldn’t file unless they are ready either. Taxpayers who file before they receive all the proper tax reporting documents run the risk of making mistakes that may lead to processing delays. Amended returns are currently taking an unprecedented amount of time to process by the IRS … Read More

Beware

Careful and keep an eye out for scammers Tax season is in full swing and the IRS wants to remind taxpayers to be on the lookout for tax scams. Criminals continue to make aggressive calls posing as IRS agents in hopes of stealing taxpayer money or personal information. Here are some red flags that should alert you that you may … Read More

Tips for preparing your tax return

Now that the holidays are in the rearview mirror and it is the start of a new year, it’s time to think about getting ready for filing your tax returns. Gathering and organizing your records in order to file your taxes could be one of the nicest things you do for yourself (and your accountant). Taxpayers should gather all year-end … Read More

Choosing the Right Tax Professional

Choosing the Right Tax Professional: As taxpayers begin to prepare to file their 2022 tax return, they may be considering hiring a tax return preparer. Based on your needs and situation, it is important to find a good fit. Remember, you are responsible for all the information on the return, regardless of who prepares it. A tax preparer with experience, … Read More

Taxpayer Bill of Rights Part 2

Taxpayer’s Bill of Rights Part 2 As taxpayers, most of us probably think that whatever the IRS says goes and that we as taxpayers don’t have much recourse. However, as a taxpayer in the United States you do have rights and they are documented in the Taxpayer Bill of Rights. One of the rights listed on the IRS website at … Read More

The Taxpayer Bill of Rights Part 1

Your rights as a taxpayer, what you need to know. If you have ever received a letter from the IRS, it’s natural for you to feel a little apprehension as you open it. You might even feel a little nausea if that letter states that you owe money. When you believe that you don’t owe the government money and the … Read More

What Is Accounting? A Guide for Small to Medium Sized Business Owners

A Guide for Small to Medium Sized Business OwnersAs an owner of a smaller business, you know you can’t gamble with your finances. Whether you file the wrong tax form or hand a messy budget to an investor, it takes one mistake to cause financial ruin. To avoid this, consider adding an accountant to your team. What exactly is accounting … Read More

Child Tax Credit Portal Update

Families receiving monthly Child Tax Credit payments can now update their direct deposit information and more! Now families can conveniently receive their monthly child tax credit payment online and with a direct deposit to your designated bank account. The account feature was added only to the Child Tax Credit portal available only on IRS.gov. This is good to know, so … Read More

Deductions and More: Getting Ready For the Next Tax Season

Americans love paying taxes. They love it so much that over 120 million of them chose to pay extra and had to get refunded.All jokes aside, there’s a lot of serious information to know when you’re prepping for tax time, and it’s never too early to get started! It could save you time and money next year.Luckily, it doesn’t have … Read More

Tax Preparation vs Tax Planning

Many people assume tax planning is the same as tax preparation, but the two are quite different. Let’s take a closer look: WHAT IS TAX PREPARATION? Tax preparation is the process of preparing and filing a tax return. Generally, it is a one-time event that culminates in signing your return and finding out whether you owe the IRS money … Read More

Taxable vs. Nontaxable Income

Tax season front and center. Some people have gotten their taxes done, good for you. This article is for the other part of the population that is still putting together the information they need to file, and those who haven’t moved a muscle to get started. Unless you are an accountant it might be hard to tell what is taxable … Read More

Social Security Benefits & Taxes: The Facts

Social Security Benefits & Taxes: The Facts Social Security benefits include monthly retirement, survivor, and disability benefits; they do not include Supplemental Security Income (SSI) payments, which are not taxable. Generally, you pay federal income taxes on your Social Security benefits only if you have other substantial income in addition to your benefits.Examples include wages, self-employment, interest, dividends, and other … Read More

Relief for Taxpayers Struggling with Tax Debt

RELIEF FOR TAXPAYERS STRUGGLING WITH TAX DEBTS While there have always been payment options available from the IRS to help taxpayers struggling to pay tax debts, the new IRS Taxpayer Relief Initiative was put into place to expand these options and offer relief during the pandemic. These revised COVID-related collection procedures will help taxpayers, especially those who have a record … Read More

Identity Protection PIN Available to All Taxpayers

Fraudulent Federal Tax Returns are on the rise!Starting in January 2021, In order to help combat this, the IRS Identity Protection PIN Opt-In Program will be expanded to all taxpayers who can properly verify their identity. Previously, IP PINs were only available to identity theft victims.WHAT IS AN IDENTITY PROTECTION PIN?An identity protection personal identification number (IP PIN) is a … Read More

Retirement Contribution Limits for 2021

Retirement Contribution Limits for 2021 Cost of living adjustments affecting dollar limitations for pension plans and other retirement-related items for 2021 are as follows:401(k), 403(b), 457 plans, and Thrift Savings Plan Contribution limits for employees who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan remain unchanged at $19,500. The catch-up contribution limit for employees … Read More

Individual Tax Payer: Recap for 2020

As we close out the year and get ready for tax season, here’s what individuals and families need to know about tax provisions for 2020. Personal Exemptions Personal exemptions are eliminated for tax years 2018 through 2025. Standard Deductions The standard deduction for married couples filing a joint return in 2020 is $24,800. For singles and married individuals … Read More

Tips for Taxpayers

Taxpayers receiving certain types of income typically reported on certain Forms 1099 and W-2G may need to have backup withholding deducted from these payments. Here are three tips to help taxpayers understand backup withholding: 1. Backup withholding is required on certain non-payroll amounts when certain conditions apply. The payer making such payments to the payee doesn’t generally withhold taxes, and … Read More

Seasonal Workers and healthcare law

Businesses often need to hire workers on a seasonal or part-time basis. For example, some businesses may need seasonal help for the harvest, holidays, commercial fishing, or sporting events. Whether you are getting paid or paying someone else, questions can often arise over whether these seasonal workers affect employers with regard to the Affordable Care Act (ACA). For the purposes … Read More

Educator Expense Deduction

HOW THE EDUCATOR EXPENSE DEDUCTION WORKS Even with COVID-19 in full swing, schooling in-person or virtual is moving on. Educators should be aware that they can deduct up to $250 of unreimbursed business expenses. If both spouses are eligible educators and file a joint return, they may deduct up to $500, but not more than $250 each. According to the … Read More

Protect Tax Records Before Disaster Strikes

We have seen in recent times how quickly our lives can be upended by natural & man made disasters. As such, it’s always a good idea to plan for what to do in case of a disaster. Here are some simple steps you can take right now to prepare: Backup Records Electronically. Many people receive bank statements by email. This … Read More

Surviving the Recession: Things you can do to keep afloat

Surviving the Recession If you are a small business owner, it has rarely been a cake walk. But, with the Pandemic still raging, it has been made incredibly challenging. It is more important than ever to get your company financially fit. The basic rules still apply for guiding you out of this financial stress test. Know the Numbers We believe … Read More

We Moved, New Rochester Office

We Moved! New Rochester, NY Office, Same Trusted Advisors One thing that will never change is that TYS is upstairs and to the right. Our landlord is demolishing our old office park, so they decided to move us! You’ll now find us at 242 Willowbrook Office Park in Fairport. We want you to know that we are the same TYS … Read More

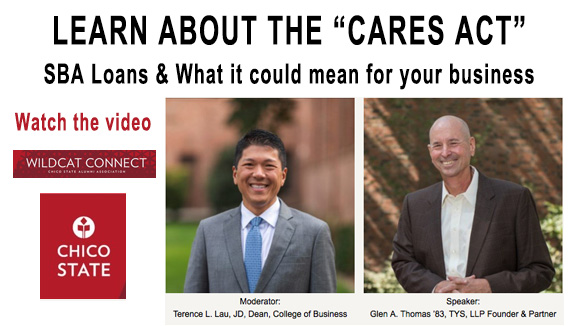

CARES ACT & SBA Loans

Learn more about the CARES ACT & the available Loans from the SBA (Small Business Administration) and what that might mean to you and your business, just watch this video of a recent webinar. Co-founder and partner of TYS LLP Glen Thomas, discuss with Terence L. Lau, JD Dean College of Business California State University, Chico explore who can benefit … Read More

IRS Announces a Filing Extension

Tax Day Filing Extension Announced Due to the economic upheaval COVID-19 has created throughout the US, the IRS is giving taxpayers a break by pushing the April 15 payment and filing deadline to July 15h of this year. Laura Saunders from the Wall Street Journal puts it ” “In short, taxpayers shouldn’t blow off their April 15 IRS filings just … Read More

Do I need to File a 2019 Tax Return?

Most people file a tax return because they have to, but even if you don’t, there are times when you should – because you might be eligible for a tax refund and not know it. The tax tips below should help you determine whether you’re one of them. GENERAL FILING RULES Whether you need to file a tax return this … Read More

Tax Season is Here!

On Monday January 27 the IRS began accepting both paper and electronic tax returns. For many it is a relief, they were ready to file when the gates came down, for others it was the beginning of a familiar anxiety. Your tax returns are due on a Wednesday, this April 15. So time is ticking away. Have you gotten started … Read More

Important Tax Changes for Businesses

Learn about the Important Tax Changes for Businesses that in store. Tac changes in tax credits, expensing & deductions have changed for 2020.

Important Tax Changes for Individuals

Every year, it’s a sure bet that there will be changes to current tax law and this year is no different. From standard deductions to health savings accounts and tax rate schedules, here’s a checklist of tax changes to help you plan the year ahead. INDIVIDUALS – THE TAX CHANGES In 2020, a number of tax provisions are affected by … Read More

Welcome Emily Callahan

TYS LLP Is pleased to welcome Emily Callahan to the TYS family as a staff accountant. While she was getting her degree in accounting from Brockport College, Emily shined as an intern with us for the past 2 years. She demonstrated a great work ethic and dedication to getting the work done. Welcome aboard Emily.

TYS, LLP Merges with Lefkowitz & Company LLP

TYS Expands Operations to Four States Walnut Creek, CA | January 7, 2020 — National accounting firm TYS, LLP (TYS) is pleased to announce that it finalized a merger with Lefkowitz & Company LLP on January 1st. TYS, a full-service tax, accounting, and business consulting firm will welcome David L. Lefkowitz and Lori Lefkowitz as Partners , along with four … Read More

SECURE Act a Boon to Employers

Small-business owners secured a major recruitment tool Small-business owners secured a major recruitment tool and an enhanced tax credit offering with the passage of the Setting Every Community Up for Retirement Enhancement (SECURE) Act by the U.S. Senate. The bill, signed by President Trump on Friday, Dec. 20, 2019, is the most significant retirement savings reform legislation in nearly 15 years. Many … Read More

Tax Season is Coming: Five Steps to Get Ready

Tax Day? What are you talking about? Tax season is not for a while yet. That may be true, but it comes quickly. The Tax Season will be here before you know it! Why not start getting ready now? 2019 could be the year you are totally prepared. In order to help you get there, TYS LLP has laid out … Read More

Do I Have to Pay Taxes on Bitcoin Transactions?

Exchanging a cryptocurrency for another, converting it back to USD or spending cryptocurrency are taxable events. Gains and losses on all individual trades must be reported to the IRS and are subject to capital gains tax.

Four Food Industry Accounting Efficiencies

Like many industries, food industry folks can benefit from some simple yet effective strategies that stress organization and efficiency. And while they may seem tedious or pesky, they can make your business more profitable and less stressful in the long term. Some of these tips are “one and done!” Others require more time and attention, but they are all incredibly helpful in making sure you’re on top of the financial part of your business.

New W-4 Form:Released In Time For 2020 Tax Year

the tax year is more complicated than it used to be. If you were surprised to find you owed taxes this year, or received a lower-than-expected refund due to the new tax laws, you’ll want to read this. The Internal Revenue Service is changing how you adjust your paycheck withholdings, and it’s more complicated than it used to be. In … Read More

Tax Surprises

No one thinks writing a check to the IRS is fun. If you have been following the news lately, you have probably heard about people who have already filed their tax returns and got a big surprise – a smaller refund, no refund or ended up owing the IRS. No one thinks writing a check to the IRS is a … Read More

QBI Deduction – Tax Cuts & Jobs Act

QBI Deduction explained The 21st century has seen a great many changes on how we work, live and play. We pretty much have abandoned the idea of working at one company for our whole careers. In fact of the freelancer or a sole proprietor part of the economy has blossomed. The Brookings Institute calls this trend the “Gig” economy and … Read More

Melissa Wallace Promotion to COO

The partners at TYS LLP are proud to announce that Melissa Wallace has been promoted to Chief Operating Officer. Melissa has been with TYS for more than 8 years and a CPA for more than 20 years. Before coming to TYS, Melissa had her own firm and has deep operational expertise that she has employed at TYS throughout her tenure. … Read More

IRS Shutdown – How worried Should You Be?

IRS Shut Down: How Worried Should You Be? What does the government partial shutdown mean regarding your tax return? Well, the IRS issued a new contingency plan to deal with the shutdown, but that hasn’t really helped tax professionals and lawmakers relax. There are gaps in the 132-page plan, but this is what we know: Returns will be accepted. Refunds … Read More

Tax Season is Coming – Part 2: Changes Are Coming!

The Changes in the new tax law will benefit and confound you. It will take more time to prepare your taxes and it will likely cost more money. Be Ready!

Tax Season is Coming – Vital things to know Part 1

Tax Cut and Jobs Act (TCJA) that was passed in late 2017, has benefited businesses both big and small. For the business who can take advantage of the Qualified Business Income or (QBI) deduction for pass through entities it can be a real boon. The new tax code sounds like an awesome opportunity, if you can take advantage of it. … Read More

Last Year of the Tax Penalty

When the Tax Cuts and Jobs Act was signed into effect in 2017, one of the least talked about changes is the repeal of the Affordable Care Act’s penalty by zeroing out fines. The individual shared responsibility provision also known as the “individual mandate” is the penalty that goes to people who do not have health insurance. The penalties didn’t … Read More

Time to delegate

Choose an accountant that understands your business What to look for when choosing an accountant When you are running a small business, cash flow, paperwork, taxes and government regulations are always on a small business owner’s mind. After all, what’s more important than managing your company’s financial affairs? Learning good small business accounting practices is a must. But, the time … Read More

Welcoming to the Team – Doris Rankins

Doris Rankins joins the TYS LLP Team TYS LLP announces the hiring of Doris Rankins, CPA as Tax Manager in their Fairport, NY office. Doris has 20 years of public accounting experience, including 3 years as tax principal for a Top 25 regional firm. Her wide ranging experience includes taxation of various entity types with a specialization in closely-held businesses. … Read More

Small firms thrive with accounting partners

Small construction companies or sub-contractors in the construction services industry have many financial challenges to consider when running their day to day operations. Key to ensuring prosperity, success and stability in the industry is preparation and sound management. The best way to simplify management and assure accuracy and accountability is to hire an experienced accounting services firm or CPA. The … Read More

Capital gains tax unchanged

Reforms under the 2018 tax bill have created significant changes for individual and business owners alike. But, happily, the new law makes few changes to investment income taxes. In fact, dividends and capital gains will stay where they were in 2017. For capital gains and qualified dividends, that means a maximum tax rate of 15% for taxpayers in the lower … Read More

Clarifying the changes to the Child Tax Credit for 2018

Titanic shifts in the United States tax code continue to rock American taxpayers. Under the Tax Cuts & Jobs Act of 2017 (TCJA) if you are a divorced parent, separated spouses or an unmarried parent, you may now be unable to fight over their children’s dependency exemptions in 2018 because lawmakers have eliminated the exemption.In 2017, the U.S. Congress passed … Read More

You’ll get more money back with the Child Tax Credit

While many aspects of the current tax reform bill are controversial, one of the most talked about part of the Tax Cut & Jobs Act also know as the Trump tax breaks is the Child Tax Credit provision. Married couples everywhere delighted with the announced increase in the child tax credit for 2018. This is the credit that taxpayers receive … Read More

Property, state and local taxes are still deductible, up to a point

A momentous change took place last December 2017 in the form of the Tax Cuts and Jobs Act (TCJA), which is the tax reform bill that placed a new limit on deductions for state and local taxes, including property taxes. Previously these deductions were unlimited for individuals, though many people who owed the alternative minimum tax lost the benefit of … Read More

Many tax deductions gone but not forgotten Part 2

Earlier this week we looked at how the new tax cuts and jobs of 2017 has changed what is deductible and what is not. Congress also included a significant reduction in mortgage interest as part of the reform package. In 2017, taxpayers could deduct interest on a mortgage of up to $1 million. Starting in 2018, only interest on the … Read More

Many tax deductions gone but not forgotten Part 1

The number nine has special significance to taxpayers in 2018 because that is the number of tax deductions that have been eliminated as result of the sweeping changes made in the Tax Cuts and Jobs Act of 2017 (TCJA). And the best way to describe it is – a case of give and take. Taxpayers can expect a lot of … Read More

Wedding Gifts from the IRS and the Disappearing Marriage Penalty

It may be rare these days for a prospective husband to ask for permission or a blessing from his future father-in-law to marry his sweetheart, but there’s one additional blessing that may also be on his mind: acquiring the tax blessings bestowed by the Internal Revenue Service. Thanks to the new tax law changes found in the Tax Cuts and … Read More

What’s New in the Tax Cuts and Job Act Part 2

Experts say the changes to the tax code for businesses are nothing short of revolutionary: a long-overdue modernization. But it’s important to remember that rate reductions don’t automatically translate into vigorous business growth. While changes wrought by the Tax Cuts and Jobs Act (TCJA) do promote corporate investment incentives, they also vary by investment type and economic sector. Here are … Read More

What’s New in the Tax Cuts and Job Act Part 1

The Trump administration’s success in pushing through the new tax legislation marks a major achievement of it’s first year. But, according to one source, “the hurried, largely furtive drafting, and rush to passage at the end of 2017, have helped obscure the new tax regime’s real impact.” Focusing on the politics has muddled the sweeping repercussions of the Tax Cuts … Read More

US Corporation tax rate now lowest in 30 years

For decades, the United States was in the top twenty of the countries paying the highest statutory corporate income tax rates. Last year, American companies had to adhere to a whopping 38.9 percent rate while other developed countries were paying 22 and 25 percent rates. In fact, the only other countries paying 35 percent or more, were the United Arab … Read More

Workplace Wellness -Part 1

As the exploding wellness industry demonstrates, healthy customers are happy customers. And because employees are the “internal customers” of every organization, it stands to reason that workplaces should focus on employee wellness. Healthy employees contribute to and draw support from a healthy workplace. It’s not just about reducing sick days or absenteeism—although that matters, too. It’s also about fostering a … Read More

Motivation in the workplace.

“Keeping talented people engaged involves some form of ownership.” –Forbes.com What motivates your employees to “give their best” at work, collaborating with a sense of purpose and passion, instead of just showing up and stewing till quitting time? The traditional answer–straight-up salary increases or equity stake–are rarely feasible in today’s culture of budget constraints, and research shows the temporary boost … Read More

#MeToo and Women in the Workplace

The hashtag #MeToo has unified millions of people, empowering them to come forward with their stories. In December, TIME magazine made these “silence-breakers” their Person of the Year, placing five on the cover—a range of backgrounds and ethnicities, from an anonymous migrant worker to superstar Taylor Swift . Fortune reports the #MeToo movement has caused an abrupt shift in acceptable workplace … Read More

Culture of Happiness

“Choose a job you love, and you will never have to work a day in your life.” That sentiment endures in fortune cookies, but otherwise flies in the face of society’s attitude toward jobs, bosses, and the hours “trapped” in the office. For too many workers in our culture, from laborers to leaders, work is not a “happy place.” Most … Read More

Sitting is the new smoking

How much do you sit on a typical day? How your employee health can adversely affect your business. If you drive to work, remain at your desk, drive home, eat dinner and then watch TV, you’re likely sitting for more hours than you’re sleeping. In today’s culture of always remaining available for clients or colleagues, eating lunch at our desks, … Read More

Meals and Entertainment Changes Under Tax Reform

In general, the new tax Act provides for stricter limits on the deductibility of business meals and entertainment expenses. Under the Act entertainment expenses incurred or paid after December 31, 2017 are nondeductible unless they fall under the specific exceptions in Code Section 274(e). One of those exceptions is for “expenses for recreation, social, or similar activities primarily for the … Read More

Building a Dream Team: Part 2: Hire Your Weakness

Let’s continue to explore the DISC concept, a feature of employee recruitment and training in businesses from government agencies to Fortune 500 companies. The “DISC” aspect stands for the four traits addressed by this model: Dominance, Influence, Steadiness and Conscientiousness. The concept of “DISC-Flex” introduces the idea that we can dial up or dial down certain behaviors to adapt to … Read More

Building a Dream Team: Part 1

Getting the right people on the bus The workplace code of conduct often outlines the unacceptable or “zero-tolerance” behaviors that employees must avoid. But what about the other side of the coin: a list of behaviors to strive for or cultivate in order to achieve excellence; or guidelines on how to play up your strengths, habits, and motivators? Rarely do … Read More

What You Need to Know About Tax Reform

The House of Representatives voted on a significant tax reform bill. For many in Congress, the stakes of tax reform have soared after lawmakers failed to repeal and replace Obamacare, with healthcare reform failing to garner enough support. Tax reform would create a palpable impact for Republicans before next year’s midterm elections. Still undergoing a flurry of changes, the House … Read More

Health care coverage impact small businesses?

President Trump signed an executive order to provide “Obamacare relief” from the Affordable Care Act, relaxing rules regarding enrollment in short-term health insurance and health care coverage offered by small businesses. Among the mandates he issued is to “consider proposing regulations or revising guidance” on options for plans that small businesses may offer and sell—including “association health plans” and low-cost, … Read More

Business Succession:

Planning for the next phase of your company Even in this age of conglomerates and chains, the family business still functions as the backbone of the American economy, representing 50 percent of the GDP and creating 60 percent of jobs in America. But the family owned business isn’t always a “mom and pop” model of simplicity and warm, fuzzy feeling; … Read More

Performance Metrics Matter

“Can I have your number?” The age-old question acquires new meaning when it describes performance metrics. Measuring everything that can be measured has become a key aspect of data gathering in the business world. Beyond basic tracking of revenue or expenses, the careful study of employee performance is now a guiding principle for industries, from hedge funds to hospitality to … Read More

Employee Incentives create performance teams

Employee incentive programs don’t have to take the form of “Employee of the Month” mug shots or birthday cake in the break room. Nor do they need to include cash bonuses or even tangible rewards to drive results, which is good news for companies strapped for cash. In fact, the best programs to keep employees “engaged, productive and invested,” according … Read More

Clarifying the changes to the 2018 child tax credit – accountant near me

Titanic shifts in the United States tax code continue to rock American taxpayers. Under the Tax Cuts & Jobs Act of 2017 (TCJA) if you are a divorced parent, separated spouses or an unmarried parent, you may now be unable to fight over their children’s 2018 dependency exemptions in 2018 because lawmakers have eliminated the exemption.In 2017, the U.S. Congress … Read More

Clarifying the changes to the 2018 taxes child tax credit

Titanic shifts in the United States tax code continue to rock American taxpayers. Under the Tax Cuts & Jobs Act of 2017 (TCJA) if you are a divorced parent, separated spouses or an unmarried parent, you may now be unable to fight over their children’s 2018 dependency exemptions in 2018 because lawmakers have eliminated the exemption.In 2017, the U.S. Congress … Read More